One of the most valuable sectors of the Canadian Space Economy is satellites. Used for communications (cell, TV, radio, internet), military and defence, agriculture, insurance, location services, Canadians benefit massively from these services, especially considering the size of the country and the spaces between each other. While controlled explosions of rockets attract a lot more attention than objects revolving invisibly and silently around the earth, we will follow the money.

Maritime Launch, a company in Nova Scotia with permission to create the first Canadian space port, plans to launch small rockets. Their early customers will all launch satellites. With a breakeven point at a single launch per year and initial capacity of 6 launches per year, this venture looks set to be wildly successful. While C6, a Canadian launch services company is sending their rockets to Brazil to launch for the next 5 years, Skyrora (UK) and [Nanoracks]() (US) are bringing business to Canada through Maritime Launch.

CubeSats Come of Age

CAPSTONE Illustration by NASA's Daniel Rutter. Source: NASA (2022).

The CAPSTONE project is fascinating on a couple of levels. Firstly, it's a CubeSat.

One interesting thing about the lunar #CAPSTONE project is that it's a cubesat that has some gov't funding, but is mostly sponsored by businesses. Many students exploring #CanadianSpace learn how to build cubesats. This technology can extend far beyond earth's orbit! https://t.co/02OJrkVwtf

— WPenner (@WPenner3) July 6, 2022

CubeSats, those cute \(10\times10\times10\) cm (or in CAPSTONE's case, 3U = 10x30x10 cm) boxes crammed full of electronics, have gone from being a toy for learning about satellites to big business in very short order. Weighing in at only 25 kgs, CAPSTONE will provide sophisticated positioning information between the moon and earth for many types of spaceships over the coming decades. 1

According to Sir Martin Sweeting 2 CAPSTONE falls into the micro-satellite scale. Satellites of only 100 grams are possible.

| Class | Mass (kg) |

|---|---|

| Large satellite | 1000 |

| Small satellite | 500 to 1000 |

| Mini-satellite | 100 to 500 |

| Micro-satellite | 10 to 100 |

| Nano-satellite | 1 to 10 |

| Pico-satellite | 0.1 to 1 |

| Femto-satellite | <0.1 |

Secondly,

I find this fascinating…

— WPenner (@WPenner3) July 6, 2022

NASA's #CAPSTONE (Cislunar Autonomous Positioning System Technology Operations and Navigation Experiment) employs a unique method of inserting the cubesat into cislunar orbit using very little fuel.

Tiny satellites are no longer limited to Earth orbit! Despite being massively underpowered compared to the Space Launch System (SLS) rocket that is attempting to launch Westerners back to the moon over the next few years, CubeSats can make their way to useful deep space locations. What this points to is CubeSat deployments that are increasingly of a sophistication level with much larger spacecraft. These small spacecraft offer Canadian space new and almost unlimited opportunities.

Profitability

Because satellites and the attending data sales are profitable, satellites are an aspect of the industry that will attract a lot of money in the years to come. It will also use its profits to invest in research and development. Expect something of an arms race amongst the biggest players as they jockey for the biggest pieces of the pie.

A main reason satellites are becoming so profitable is advances in data processing. We have pointed satellite cameras and other sensing devices at earth for decades. The collected data, rather than being thrown away, is providing increasingly rich context for trailblazing analytics to mine insights from. New algorithms and "artificial intelligence" techniques can make sense of the unbelievably large databases now available for free or at reasonable cost. This comes when hardware for running such analysis has dropped significantly and price and increased in power simultaneously.

ARK research estimates that the cost of AI processing drops by half ever nine months. The data side of the satellite business cannot help but benefit from 9 month halving rates. It is possible a customer contract signed today for a loss could be profitable by the end of the year and lucrative in 2 years' time as the cost of servicing the contract fall precipitously.

Customers will benefit as the same cost will provide more insights as more numbers can be crunched and more insights gleaned. The result should be better decision making and profitability in key areas of the Canadian economy, like agriculture, maritime industries, oil and gas, and insurance.

It's been said that "data is the new oil" because it will fuel the economies of the future in so many ways. The Canadian Space Agency's investment into the data sector should help keep Canadians from falling too far behind in this new space race.

Canadian Companies

There are several important Canadian companies in the satellite space.

4pi Lab is a Calgary-based company developing a constellation of high-performance satellites that use non-thermal sensors to detect, geo-locate, and report very small wildfires in real time. The company's prospects are bright, as Alberta is far from the only location plagued with the problem of forest fires.

Galaxia is a Halifax-based company that creates plug-and-play hardware for satellites that allows for real-time earth observation (EO) and data processing backed up by AWS compute services for more detailed analysis. Customers can buy the hardware or data flows on a pay-per-use basis. Galaxia is part of the burgeoning Commercial-Off-The-Shelf (COTS) ecosystem that enables satellite owners to build and fly ships faster than ever. Geoffrey Moore in Crossing the Chasm would consider manufacturers like Galaxia a sign of the beginning of the commercially viable side of the chasm.

GHGSat is a Canadian earth observation company that sells emissions metrics to industry (e.g. oil & gas, waste management, coal, agriculture) and government customers.

They position themselves as fighting climate change because the main chemical they detect is methane, a key greenhouse gas, which is 30x more potent than carbon dioxide as a greenhouse gas.

R3 IoT is a communications and data analytics company that has developed a smart gateway and cloud platform that connects IoT devices to the cloud using a combination of satellite and cellular networks. The venture provides reliable access to data and analytics capabilities for customers in industries such as agriculture, aquaculture, and energy operating in remote areas without traditional communications infrastructure.

SkyWatch, a Kitchener-based company, markets a tool called EarthCache, which provides software developers with the tools they need to cost-effectively add Earth observation data into their applications and workflows. They aim to remove complexity from Earth observation data sourcing and processing, allowing customers to focus on the highest priorities.

Spacebridge is a Quebec-based company that builds high-end, enterprise grade broadband solutions. Their target customers are banks, retail businesses, oil exploration and gas stations not in urban centres. The defence sector is a major contractor of their services, benefiting from reliable, high-grade communications in remote locations, like at sea. Their chief competition is currently SpaceX, which tells a better story and dramatically out-innovates Spacebridge. Spacebridge will need to work hard in the coming years in order to stay relevant and profitable.

Wyvern, is an Edmonton-based company which builds and deploys CubeSats to collect high-quality hyperspectral images of Earth. Their approach leverages deployable optics and orbiting closer to Earth than traditional satellites. Wyvern is working on hardware that processes information in space before satellites send it to servers on earth. This is partially possible because the hardware has improved, but also because electrical generation on board is better.

A Bumpy Road Map

Not everything is sunshine and roses in the world of satellites, unfortunately. A key issue is the increasing number of objects in Earth orbit.

In November 2021, Space.com3 put the number of satellites launched since 1957 at 12,170. Of those, 7,630 were in orbit at the time with some 4,700 operational. Besides the roughly 3,000 defunct satellites, other space junk includes used rocket upper stages and debris from deliberate destruction of satellites by Russian and Chinese tests.

As of last year, plans for the following large satellite constellations were public:

- SpaceX is aiming for 40,000 craft in its Starlink constellation.

- OneWeb plans a 648 craft constellation that seems likely to grow.

- Amazon plans 3,200 craft and

- Astra has applied for a 13,600-satellite constellation.3 While these numbers seem huge, they are only the tip of the proverbial iceberg.

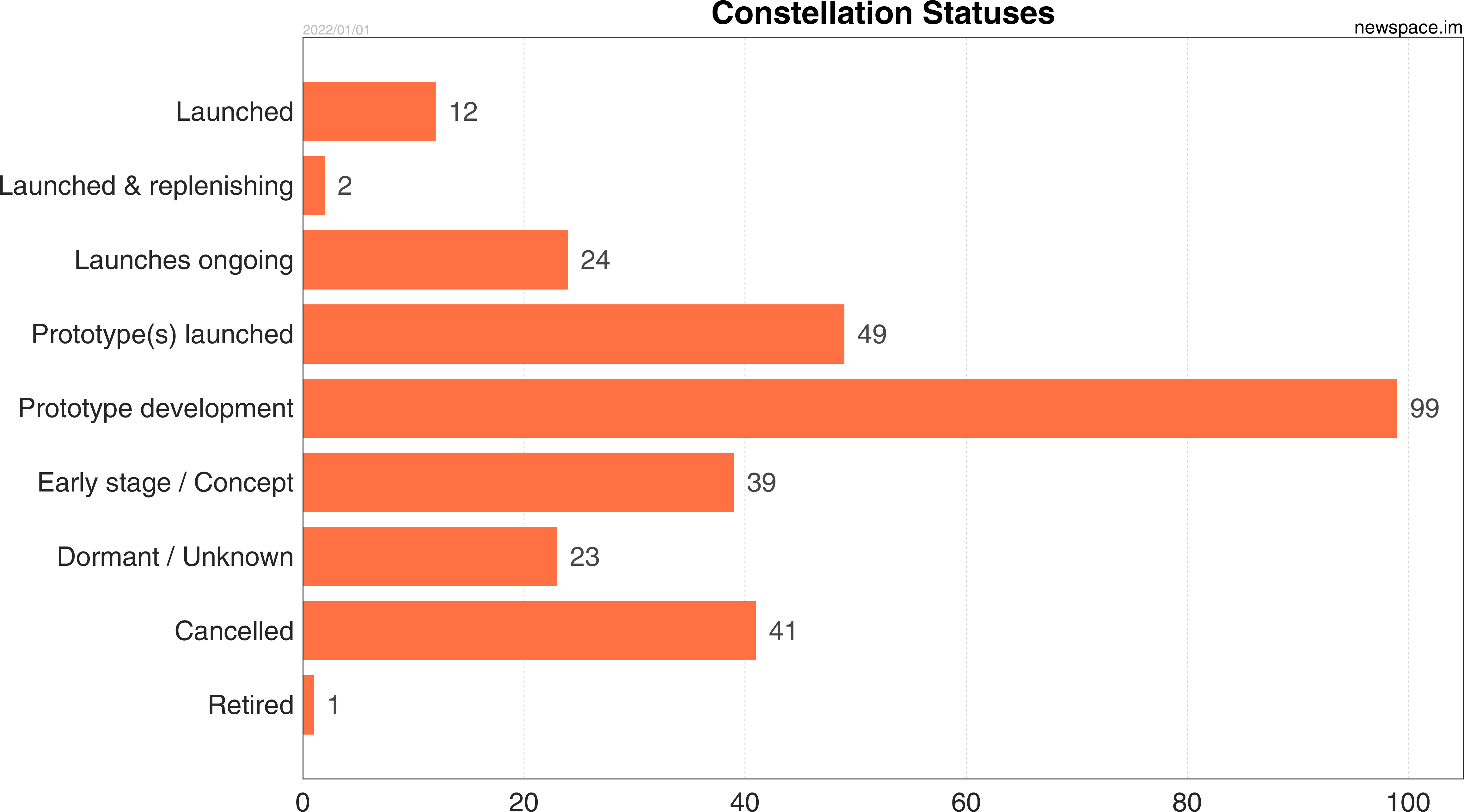

Here in Canada, the NewSpace Index, run by Erik Kulu, tracks satellite constellations, small launchers and space funding in a public database. The following graph shows that while only a small number have launched so far, many more are in the prototype or development stage.

Constellations Statuses. Source: Kulu, E. (2022) Newspace Index.

A risk that each ship in orbit faces is collision with another object. A satellite at the altitude of the ISS (400 km) must maintain a speed of 27,500 kph or it loses its orbit. At that speed, items as small as a paint fleck can do enough damage to a spacecraft to render it inoperable.

The apocalyptic scenario of the Kessler Syndrome, where cascading collisions create a debris field that locks humanity forever on the planet, unable to get into space safely, has not happened yet. The topic is currently hotly debated, with Russia and China offering a concerning alternative perspective.

-

Hall, L. (2020, July 31). What is CAPSTONE? NASA. https://www.nasa.gov/directorates/spacetech/small_spacecraft/capstone ↩

-

Sweeting, M. (2018). Modern small satellites-changing the economics of space. Proceedings of the IEEE, 106(3), 343-361. ↩

-

Wall, M. (2021, November 15). Kessler Syndrome and the space debris problem. Space. https://www.space.com/kessler-syndrome-space-debris ↩ ↩